Below, we outline some of our key views on the factors set to drive financial markets over the coming months, and what this means for our investment strategies.

What's next for the global economy and financial markets?

The art of the deal…

So far this year, Mr Trump, and his Truth Social account, have been busy reacquainting the world with the original meaning of ‘US exceptionalism’. In just a few weeks, he’s rained missiles on Venezuela, abducted its leader, and its oil industry. He’s had the Justice Department subpoena Jay Powell, the chair of the Federal Reserve (Fed), and threatened Britain, and seven other European allies, with fresh trade tariffs should they fail to rubber-stamp his proposed purchase of Greenland.

With mid-term elections in November, Mr Trump is just as busy at home. He’s demanded that US credit-card issuers cap interest rates at 10%; that US institutional investors be banned from purchasing single-family homes; that the Fed cut interest rates to 1%; that gas prices are slashed to $2 a gallon; that US weapons manufacturers build new factories and up production; that Congress boost US military spending 50% to $1.5trn in 2027; and promised $2,000 ‘stimulus checks’ to voters, somehow cut from his trade tariffs.

Although global stock markets have mostly shrugged off Mr Trump’s bombastic demonstration of US ‘hard power’, his domestic ‘policy’ has impacted US share prices. It’s also sent gold and silver prices into the stratosphere.

America’s quiet revolution

The US economy is in the midst of a broad-based, technology-led industrial revolution. The latest numbers show US GDP leapt 4.4% (annualised) in the third quarter, leaving its peers in the dust. US inflation is also making progress; it hit 2.7% in November.

Recent weeks have also seen US productivity numbers land. These are the stuff of dreams for other developed economies. After averaging annual productivity gains of around 1% in the decade to 2019, US productivity growth doubled to 2% in the next five years before jumping to 2.9% in 2024. In the third quarter of 2025, it soared to 4.9%.

The stunning productivity figures confirm that the US is undergoing a technology-led productivity revolution that pre-dates AI. Such tech-driven gains raise growth and reduce inflation. With real wages rising slower than productivity, this is a ‘Goldilocks’ scenario for the US economy, namely accelerated growth without worrisome inflation – the dreaded ‘cycle killer’. The prospect of significant gains in GDP growth, alongside contained inflation, offers tremendous potential for US company earnings and, by extension, US share prices.

Asia’s sleeping giant stirs

Japanese shares have been flying ever since new Prime Minister Sanae Takaichi, the country’s first female leader, came to power in the autumn. In mid-January, Japan's Nikkei 225 Index surged to a new record high as investors bet that Takaichi’s calls for a snap election would lead to more fiscal stimulus. Meanwhile, the yen tumbled to new lows, boosting Japanese corporate earnings and share prices.

But the promise of greater fiscal stimulus has spooked Japan’s bond markets. The yields on long-dated bonds recently hit their highest since 1999 (meaning prices were at record lows). This is because decades of government spending to combat deflation has left Japan with the highest level of debt-to-GDP in the world.

We may also see other, unintended, consequences. If Japan borrows still more to ignite its dormant economy, it’s likely to result in rising interest rates and a stronger yen. This will undermine both Japan’s export-oriented stock market and the enormous yen ‘carry trade’ where global investors borrow in a low-yielding currency (the yen) to invest in a higher-yielding one.

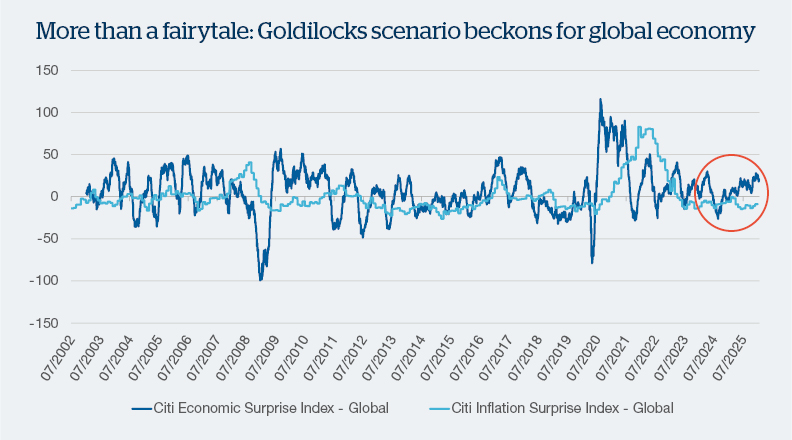

Our chart of the month

Source: Citigroup, Macrobond. Data as at 21 January 2026.

What does this chart tell us?

The above chart shows the progress of two ‘surprise’ indices since 2002. One is an index of economic surprises, the other an index of inflation surprises. They’re calculated by subtracting actual economic and inflation data from consensus economic and inflation estimates, which produces a directional progression of ‘surprises’.

As such, the direction of travel for each line is the important factor here.

The most important aspect of the above chart is the continuing divergence of the two lines. Namely, that for almost two years we’ve seen global economic surprises turn consistently positive, driven in no small by the US economy.

Meanwhile, inflation surprises have turned negative, reflecting that, globally, central bank actions to raise interest rates have been successful in quelling the post-lockdown return of inflation. Boosted by the impact that the war in Ukraine had on European energy prices, this led to a cost-of-living crisis on both sides of the Atlantic.

We expect both surprise indices to continue on their current trajectory thanks to a robust US economy, ongoing fiscal expansion (meaning increased government spending) in Europe, and expectations of government stimulus in China later in the year. The continued weakness of the US dollar will also help to drive emerging markets. Meanwhile, central banks have mostly brought inflation under control with only the US and UK expected to cut interest rates again 2026.

In simple terms, more ‘good news’ and less ‘bad news’ (in the form of inflation) is a ‘Goldilocks scenario’ for stock markets. Expect to see a great many references to this in 2026.

Scroll down the page to find out what our market views mean for positioning in our investment funds.

- Despite the backdrop of robust economic fundamentals, such as strong company earnings, falling interest rates, substantial economic growth in the US, and waning inflation, that are now coming through, we’re broadly ‘neutral’ on our stock market exposure. This means our total holdings are much in line with the levels in our model portfolio.

- This reflects rising geopolitical risks in the form of Ukraine, Venezuela, Iran and, most recently Greenland. Although stock markets have, so far, mostly looked past the political noise, this won’t always be the case – especially if we see extended bouts of tariff ‘tit-for-tat’ as Mr Trump attempts to ‘make America great again’ (MAGA).

- We have recently trimmed our exposure to US stock markets back to ‘neutral’. This enabled us to add to our European and emerging market exposure as we see better opportunities here thanks to the likely weakness of the US dollar in 2026, the coming surge in European defence and infrastructure spending, and further stimulus in China as the year progresses.

- While there’s clearly a great deal of ‘good news’ in the economic picture, it’s also clear that much of this has already been ‘priced-in’ to stock market valuations. There’s also a high degree of consensus in investor forecasts for 2026 (something which invariably heralds a major upset). Consequently, this is no time to be ‘overweight’ to shares.

- In line with this, we also hold a ‘put option’ that acts as cost-effective portfolio insurance as it will pay out if stock markets suffer a significant upset in the first quarter.

- From a thematic perspective, we continue to favour insurance and healthcare companies right across our portfolio range. We also have additional technology exposure for our higher growth portfolios.

Our stock market exposure

- As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund, which sits at the mid-point of our portfolio range in terms of the balance between risk and reward, held 64.5% of its portfolio in company shares, which represented a small overweight compared to our model portfolio.

- Within this, our allocation to US stocks was by far the largest; it accounted for over 40% of our total stock market exposure. The UK was the second-largest exposure followed by global equity strategies, our European stock market holdings and, close behind, our emerging market exposure.

- A much smaller holding in Japanese companies completes the fund’s stock market holdings. Our current weighting here is considerably underweight relative to our model portfolio.

As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund held a small overweight to stock markets, compared to our model portfolio.

- Starting in late 2024, and continuing through 2025, we gradually trimmed our exposure to bond markets as a period of synchronised interest-rate cuts from central banks came to a close, signalling the end of a period of bumper bond market returns.

- Even so, fixed-income investments, namely bonds, are still a core holding in our portfolios with our total exposure now back to ‘neutral’ (meaning that it’s much in line with our model portfolio).

- The exception to this remains UK government bonds or gilts. Thanks to the UK’s anaemic economy, which features meagre growth, guttering employment and rising government spending that’s resulted in a fearsome tax burden, its government bonds continue to offer better value than their peers and we remain ‘overweight’ here relative to our model portfolio.

- The transition from a period of synchronised interest-rate cuts from central banks introduces an element of ‘two-way’ risk in bond markets with the US and UK still expected to cut rates further in the coming year, others will stick where they are, while the likes of Europe, Japan and Australia, for example, are expected to start raising rates again this year.

- With the great bulk of global rate cuts now behind us for this monetary cycle, the peak for bond market returns is also now in the rear-view mirror. With increased fiscal spending – think US tax rebates, European defence spending, and potential government stimulus from the likes of China and Japan among others this year – we could also see economic growth, and inflation, pushing higher once more. Both of which would depress bond markets.

- This means we expect bond investors to be in for a period of ‘coupon clipping’ – namely collecting the income payments from bonds with little in the way of capital gains.

Our bond market exposure

- As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund held 25.6% of its portfolio in bonds. Within this, just over 12% was in government bonds compared to our model portfolio weight of 9.9%, thanks to our overweight to UK government bonds or gilts.

- The fund also held over 11% in corporate bonds (issued by companies). Just over 70% of this was in higher-quality, investment-grade bonds with the remainder in higher-yielding bonds of lower credit quality. This represented a slight underweight compared to our model portfolio.

- The fund’s small position in emerging market bonds was in line with our model weighting.

As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund held a small overweight to bond markets, compared to our model portfolio

The ‘alternative’ investment space covers an enormous universe of competing strategies and asset classes from commodities and commercial property to specialist hedge funds that employ a diverse spectrum of strategies. Consequently, broad statements as to our view on the market as a whole are redundant.

In the alternatives space we hold only gold, a select group of hedge fund strategies, and a small position in commercial property.

- Although we’re broadly ‘underweight’ to alternatives, relative to our model portfolio, we have significant positions in gold, hedge funds, and a small but growing exposure to property assets where we’ve recently been reducing our underweight.

- We hold gold as the best means to ‘hedge’ the geopolitical risks emanating from the US and have been well rewarded for this since Mr Trump was re-elected.

- We hold hedge funds that can help protect us from violent market disruptions by providing returns with a low correlation to the movement of stock and bond markets, and we’re increasing our global property exposure from ‘underweight’ to ‘neutral’ as such assets should benefit from here as the economic cycle progresses.

Our alternatives market exposure

- As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund held just over 10% of its portfolio in alternative asset classes intended to deliver diversification from its stock market and bond holdings.

- Our exposure to gold constituted almost half of this weighting with our specialist hedge fund positions and our small exposure to property accounting for the rest.

- For the Balanced Multi Asset Fund this represented a slight underweight compared to our model portfolio.

As at 19 January 2026, the Handelsbanken Balanced Multi Asset Fund held a slight underweight to alternative asset classes, compared to our model portfolio.

If you’d like further information on how we divide investments in our strategies across different types of assets (i.e. our asset allocation framework, and our tactical deviations away from it), please contact us.

Important Information

Handelsbanken Wealth & Asset Management Limited is authorised and regulated by the Financial Conduct Authority (FCA) in the conduct of investment and protection business, and is a wholly-owned subsidiary of Handelsbanken plc. For further information on our investment services go to wealthandasset.handelsbanken.co.uk/important-information. Tax advice which does not contain any investment element is not regulated by the FCA. Professional advice should be taken before any course of action is pursued.

- Find out more about our services by contacting us on 01892 701803 or exploring the rest of our website: wealthandasset.handelsbanken.co.uk

- Read about how our investment services are regulated, and other important information: wealthandasset.handelsbanken.co.uk/important-information

- Learn more about wealth and investment concepts in our Learning Zone: wealthandasset.handelsbanken.co.uk/learning-zone/

- Understand more about the language and terminology used in the financial services industry and our own publications through our Glossary of Terms: wealthandasset.handelsbanken.co.uk/glossary-of-terms/

All commentary and data is valid, to the best of our knowledge, at the time of publication. This document is not intended to be a definitive analysis of financial or other markets and does not constitute any recommendation to buy, sell or otherwise trade in any of the investments mentioned. The value of any investment and income from it is not guaranteed and can fall as well as rise, so your capital is at risk.

We manage our investment strategies in accordance with pre-defined risk objectives, which vary depending on the strategy’s risk profile.

Portfolios may include individual investments in structured products, foreign currencies and funds (including funds not regulated by the FCA) which may individually have a relatively high risk profile. The portfolios may specifically include hedge funds, property funds, private equity funds and other funds which may have limited liquidity. Changes in exchange rates between currencies can cause investments of income to go down or up.

This document has been issued by Handelsbanken Wealth & Asset Management Limited. For Handelsbanken Multi Asset Funds, the Authorised Corporate Director is Handelsbanken ACD Limited, which is a wholly-owned subsidiary of Handelsbanken Wealth & Asset Management, and is authorised and regulated by the Financial Conduct Authority (FCA). The Registrar and Depositary is The Bank of New York Mellon (International) Limited, which is authorised by the Prudential Regulation Authority and regulated by the FCA. The Investment Manager is Handelsbanken Wealth & Asset Management Limited, which is authorised and regulated by

the FCA.

Before investing in a Handelsbanken Multi Asset Fund you should read the Key Investor Information Document (KIID) as it contains important information regarding the fund including charges and specific risk warnings. The Prospectus, Key Investor Information Document, current prices and latest report and accounts are available from the following webpage: wealthandasset.handelsbanken.co.uk/fund-information/fund-information/, or you can request these from Handelsbanken Wealth & Asset Management Limited or Handelsbanken ACD Limited: 25 Basinghall Street, London EC2V 5HA or by telephone on 01892 701803.

Registered Head Office: 25 Basinghall Street, London EC2V 5HA. Registered in England No: 4132340